The Indian solar industry is currently witnessing a “Gold Rush” era. Driven by the PM-Surya Ghar: Muft Bijli Yojana and skyrocketing commercial electricity tariffs, rooftop solar has moved from being an environmental luxury to a middle-class financial essential. However, for the solar installer, this boom brings a chaotic challenge: How do you cut through the noise of curiosity-seekers to find genuine, high-intent buyers?In 2025, the role of a solar lead generation company has evolved. It is no longer about selling a spreadsheet of phone numbers; it is about providing a pre-qualified bridge to a closed deal. This guide explores the massive shift from traditional cold calling to automated digital appointment setting and how it is revolutionizing the Indian solar market.

1. The Death of the “Cold” Lead in India: Why a Solar Lead Generation Company Is Now Essential

Traditional marketing—like newspaper inserts, canopy activities in housing societies, and buying generic databases—is rapidly losing its ROI. The modern Indian consumer is digitally savvy and privacy-conscious.

Why Traditional Methods are Failing for a Solar Lead Generation Company

- Ad Fatigue: Homeowners in cities like Delhi, Mumbai, and Bangalore are bombarded with generic solar ads.

- Low Intent: Traditional “bulk” leads often include tenants or people who cannot afford the upfront cost.

- The Trust Gap: Generic cold calling creates annoyance rather than authority.

In contrast, a modern solar lead generation company uses educational content to pull customers in. When a homeowner searches for “How much can I save with 3kW solar in Jaipur?”, they are demonstrating High Intent.

2. Comparing Traditional vs. Modern Digital Lead Generation for a Solar Lead Generation Company

To understand the “Game,” we must compare the two methodologies head-to-head.

The Lead Generation Comparison Table

| Feature | Traditional Marketing (Flyers/Cold Calls) | Digital Appointment Setting (SEO/Ads) |

| Primary Audience | Mass market (Untargeted) | High-Intent (Self-Qualified) |

| Data Accuracy | Low (Outdated lists) | Verified (Current contact details) |

| Lead Exclusivity | Often sold to 10+ people | Exclusive (Sold only to you) |

| Cost per Sale | High (Due to wasted labor) | Low (Due to high conversion rates) |

| Speed of Contact | Days or weeks | Minutes (Automated alerts) |

| Indian Subsidy Awareness | Confused buyers | Educated on PM-Surya Ghar Yojana |

3. The Digital Appointment Setting Process

The true “game-changer” is not just the lead—it is the appointment. Most Indian solar installers lose 60% of their leads because they don’t follow up fast enough. Professional lead gen companies now offer a managed sales funnel.

Step-by-Step Flow of a Digital Lead:

- Search & Education: The customer finds an article on subsidy benefits or solar ROI.

- The Qualification Hook: Instead of a simple “Call Us” button, they fill out a form detailing their monthly electricity bill (₹2,500+ threshold) and roof ownership status.

- Instant AI Verification: An automated WhatsApp bot sends a message: “Namaste! To provide an accurate quote, do you have a sanctioned load of 3kW or more?”

- The Hand-off: Only once verified, the lead is injected into your CRM.

- The Confirmed Slot: The system syncs with your sales rep’s calendar, booking a Technical Site Survey.

4. Why “Speed-to-Lead” is the Survival Metric in India

In the digital world, the first company to call usually wins the deal.

- The 5-Minute Rule: If a solar installer contacts a digital lead within 5 minutes, they are 21 times more likely to qualify that lead compared to waiting 30 minutes.

- The Indian WhatsApp Advantage: In India, an email is easily ignored. A WhatsApp message with a PDF Case Study of a local installation in the same neighborhood builds instant trust.

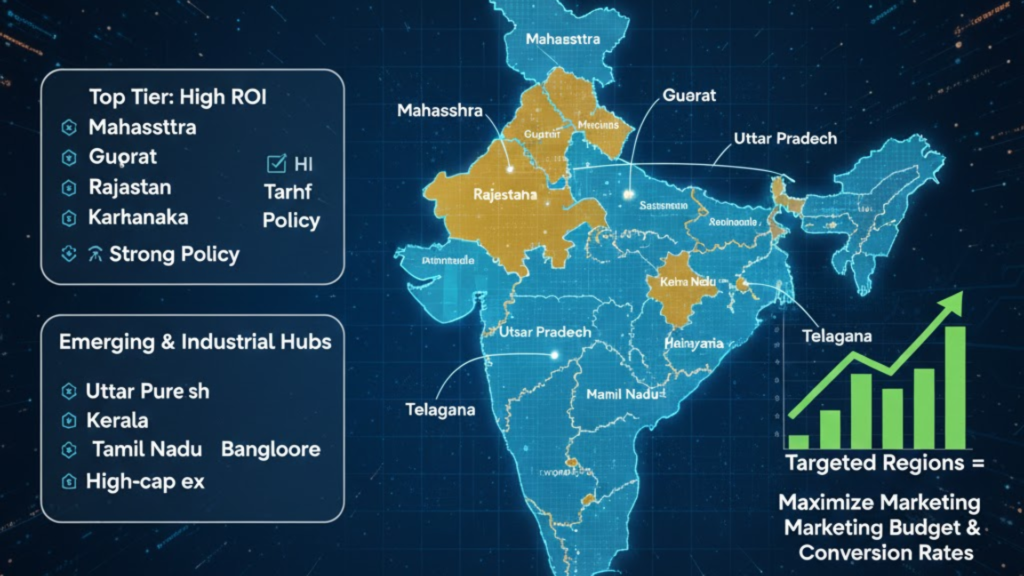

5. Identifying the “Golden States” for Solar Leads

Not all regions in India offer the same conversion potential. A specialized solar lead generation company uses geographic data to spend your marketing budget where it matters most.

- Top Tier (High Tariff & High Policy Support): Maharashtra, Gujarat, Rajasthan, Karnataka.

- Emerging Tier (High Subsidies): Uttar Pradesh, Kerala, Tamil Nadu.

- Industrial Hubs (High Capex Leads): Haryana and Telangana.

By targeting specific states, you avoid wasting money on regions where net-metering approvals are slow or electricity is already heavily subsidized, making solar less attractive.

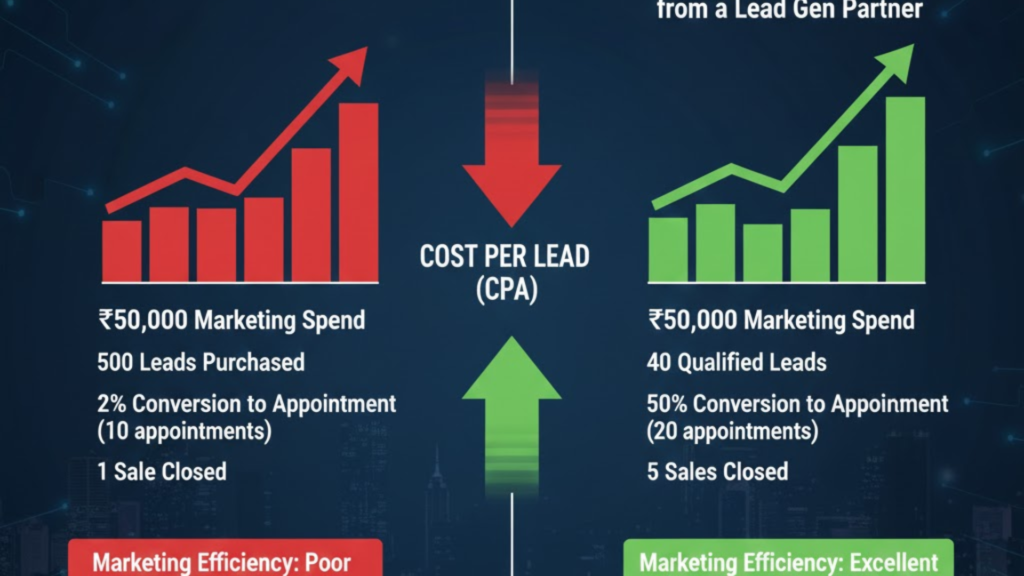

6. Financial Analysis: Cost Per Lead (CPL) vs. Cost Per Acquisition (CPA)

Many installers panic at the price of a “Premium Lead” (₹800–₹1,500) compared to a “Cheap Lead” (₹50–₹100). Let’s do the math on a 1500-word deep dive into the budget:

Case Study: The ₹50,000 Marketing Spend

- Scenario A: Cheap Leads

- Leads Purchased: 500

- Conversion to Appointment: 2% (10 appointments)

- Sales Closed: 1

- Total Revenue: ₹2,50,000

- Marketing Efficiency: Poor (High labor cost to call 500 people)

- Scenario B: Digital Appointments from a Lead Gen Partner

- Leads Purchased: 40 (Highly qualified)

- Conversion to Appointment: 50% (20 appointments)

- Sales Closed: 5

- Total Revenue: ₹12,50,000

- Marketing Efficiency: Excellent (Sales team spends time on site, not on phones)

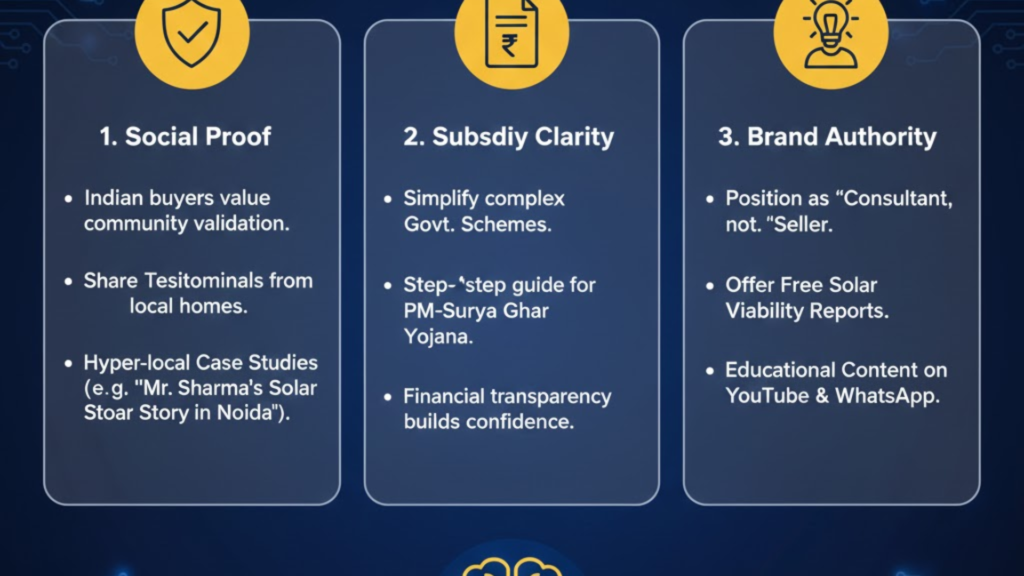

7. The Psychographics of the Indian Solar Buyer

Understanding the mindset is key. The Indian buyer is Risk-Averse and Savings-Driven.

How a lead gen company builds trust before you arrive:

- Social Proof: Sending testimonials from other homeowners in their city.

- Subsidy Clarity: Providing a simple “How to Apply” guide for the PM-Surya Ghar portal.

- Brand Authority: Positioning the installer as a “Solar Consultant” rather than a “Seller.”

Frequently Asked Questions (FAQ) for Solar Businesses

Q1: What exactly does a “Solar Lead Generation Company” do?

A: They manage digital marketing (Google/Meta ads, SEO) to find homeowners interested in solar. They qualify these people based on budget and roof space and deliver their contact info exclusively to you.

Q2: Are leads from the government portal (PM-Surya Ghar) enough?

A: No. While the portal is great for tracking, it is not a marketing engine. To grow, you need to find customers before they register on the portal so you can guide them as their chosen installer.

Q3: What is a “Site-Visit-Ready” lead?

A: This is a lead that has confirmed property ownership, has a bill exceeding the profitable threshold, and has agreed to a specific time for an engineer to visit the site.

Q4: How do I handle leads that say “Solar is too expensive”?

A: High-quality leads are already educated on EMI options and bank financing. Digital leads usually come pre-loaded with info on payback periods (ROI in 3-4 years), making the “expense” objection easier to handle.

Q5: Can I target only Commercial & Industrial (C&I) leads?

A: Yes. Many solar lead generation companies allow you to filter for “Commercial” leads where the billing cycle is much higher (₹50,000+ monthly), though these leads are more expensive per unit.

Leveraging WhatsApp for Lead Nurturing

In the Indian context, WhatsApp is your CRM.

- Automated Sequences: The moment a digital lead is generated, send them a “Site Survey Preparation Checklist”.

- Visual Trust: Send high-resolution photos of your Net-Meter installation success stories.

- Reminders: Automated appointment reminders reduce “No-shows” by 40%.

Conclusion: Choosing Your Growth Partner

The “Game” of solar in India is no longer about who has the cheapest Chinese or Indian modules. It is about who can control the customer journey.

If you are a solar installer looking to scale from 5 to 50 installations a month, you cannot rely on local “referrals” alone. You need a data-driven solar lead generation company that delivers Exclusive Digital Appointments.

Key Takeaways for Your Strategy:

- Stop buying lists; start buying appointments.

- Focus on the “5-Minute” contact rule.

- Educate the lead on subsidies before the site visit.

- Target regions with high electricity tariffs for the best ROI.

By embracing digital leads, you stop being a “Salesman” and become a “Solar Solutions Provider.” The future of appointment setting is fast, automated, and highly profitable.